Paving the Way for Seamless Transactions: Exploring Payment Services in Telecommunications

In an era where convenience and speed are paramount, payment services in the telecommunications space have become a game-changer, transforming how we handle financial transactions and interact with our mobile devices. Gone are the days of carrying wads of cash or standing in long queues at the bank. With the fusion of telecommunication and payment services, a world of seamless transactions has emerged. In this blog post, we embark on a captivating journey to explore the realm of payment services in the telecommunications industry, uncovering the innovations that have revolutionized the way we pay.

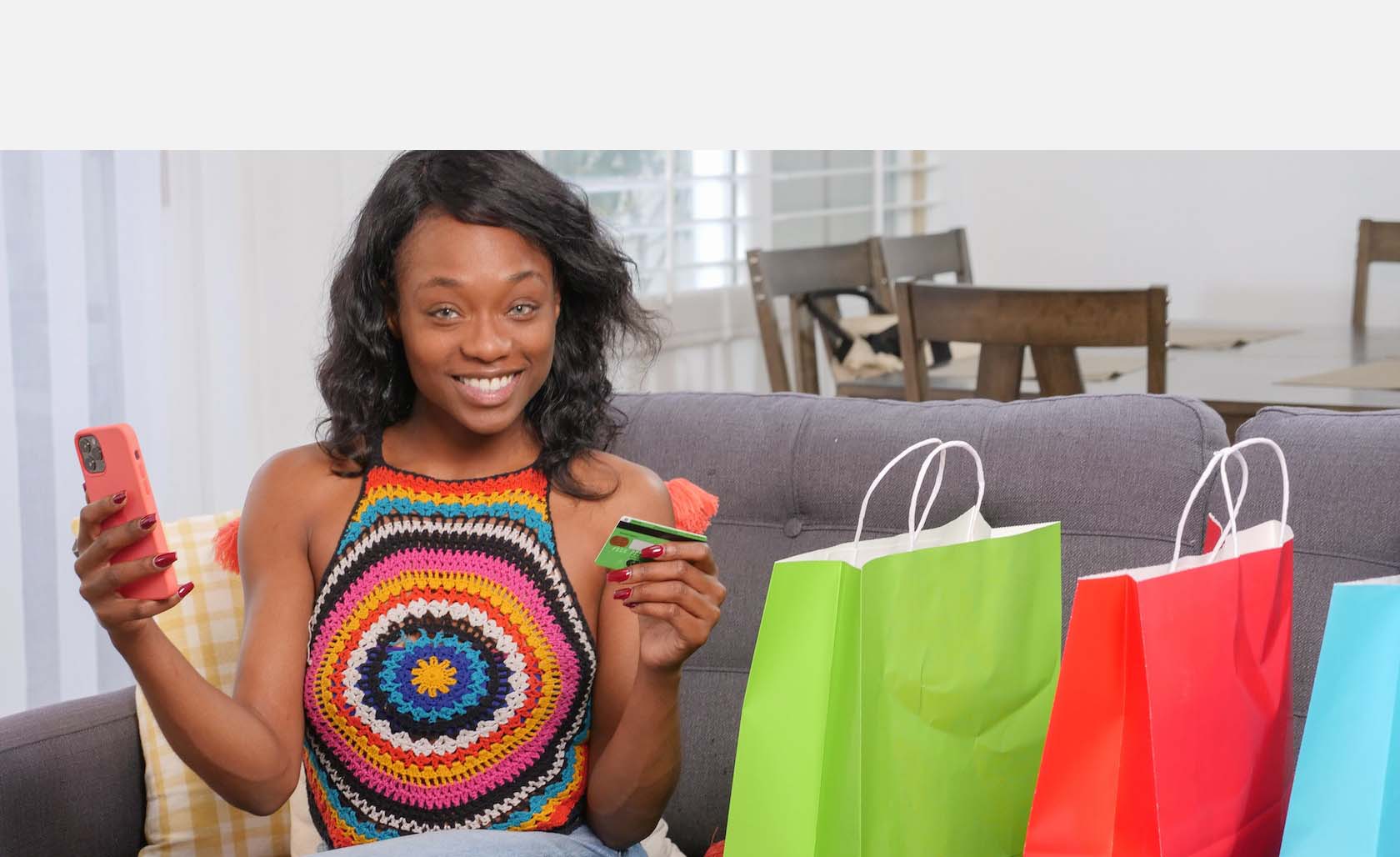

- The Evolution of Mobile Payments

Mobile payments have come a long way since their inception. From the humble beginnings of SMS-based transactions to the sophisticated mobile wallet solutions available today, payment services have undergone a significant transformation. The introduction of Near Field Communication (NFC) technology and secure mobile apps has facilitated contactless payments, allowing users to make purchases with a simple tap of their smartphones. Whether it’s paying for groceries, booking a ride, or settling bills, mobile payments have become an integral part of our daily lives, offering unparalleled convenience and efficiency.

- Mobile Wallets: Your Virtual Money Keeper

One of the most revolutionary innovations in payment services has been the advent of mobile wallets. These virtual money keepers have replaced the need to carry physical wallets, as they securely store credit card information, loyalty cards, and even cryptocurrencies. Mobile wallets provide users with a centralized platform to manage their finances, monitor transactions, and access exclusive deals and discounts. With built-in security features such as biometric authentication and encryption, mobile wallets have become a trusted and secure means of making digital payments.

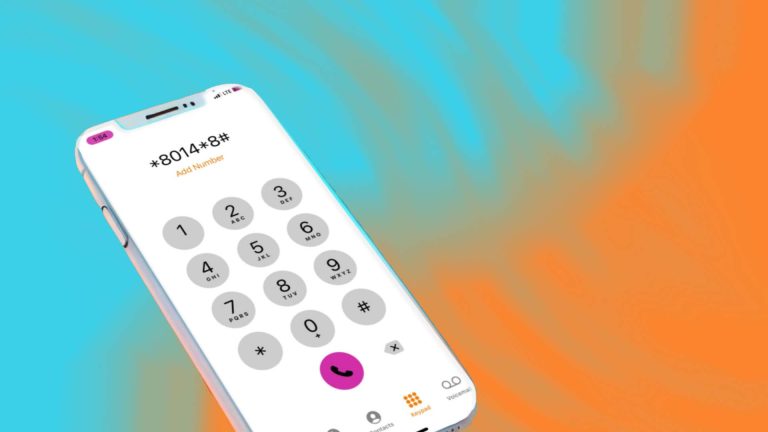

- Financial Inclusion through Mobile Banking

Payment services in the telecommunications industry have also played a pivotal role in promoting financial inclusion, especially in underserved and remote areas. Mobile banking services empower users to access banking facilities without the need for a traditional bank account. Through simple USSD codes or mobile apps, individuals can deposit and withdraw money, make transfers, and even apply for loans. These services have bridged the gap between the banked and the unbanked, empowering millions of people to participate in the formal financial system.

- Unlocking Cross-Border Payments

The global nature of telecommunications has paved the way for cross-border payment services, breaking down barriers in international transactions. Whether it’s sending remittances to family overseas or conducting business with foreign clients, cross-border payment solutions offer competitive exchange rates and fast transfers, eliminating the complexities of traditional banking channels. As the world becomes more interconnected, these services have become indispensable for individuals and businesses with international ties.

- The Future of Payment Services

As technology continues to advance, payment services in telecommunications are poised for even greater transformations. The integration of Artificial Intelligence (AI) and blockchain technology promises enhanced security and fraud detection, providing users with peace of mind in their digital transactions. Additionally, the rise of 5G networks will further enhance the speed and reliability of payment services, enabling real-time transactions and a seamless user experience.

In conclusion, payment services in the telecommunications space have revolutionized the way we handle financial transactions, making it easier, faster, and more secure to pay for goods and services. From the evolution of mobile payments to the rise of mobile wallets and the drive towards financial inclusion, these services have reshaped the digital economy. As technology continues to push the boundaries, we can expect payment services to evolve further, offering a world of convenience and possibilities at our fingertips. So, embrace the power of payment services and experience the freedom of seamless transactions in the digital age.